This week is the last hurrah of summer, so something different this time: a look at what’s been happening in Big Tech at large, primarily with a number of the FAANG companies – Facebook, Amazon, Apple, Netflix and Google, for those playing the home version – or more appropriately now MAANG, since Facebook is now Meta – and for our purposes here, MAANGO, as we’re including Oracle and some information that recently came to light. Plus, mangos are very much a summer fruit, after all.

Oracle

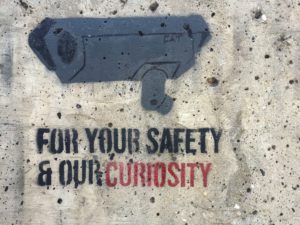

Speaking of just when you thought it was safe to go back into the water (not!): Class-Action Lawsuit Accuses Oracle of Tracking 5 Billion People. “Oracle stands accused of collecting detailed dossiers on 5 billion people, with the information gathered including names, home addresses, emails, purchases online and in the real world, physical movements in the real world, income, interests and political views, and a detailed account of online activity,” PC Mag reported.

“This claim is backed up by a video on the ICCL website(Opens in a new window) of Oracle CEO Larry Ellison describing how the company’s real-time machine learning system collects this information and confirms the 5 billion profiles stored in the “Oracle Data Cloud.” The profiles are referred to as a “Consumers Identity Graph.”” Read More...